An International Digital Yuan: (Vane) Ambitions, (Excessive) Alarmism and (Pragmatic) Expectations

Days after the European Central Bank (ECB) publicly disclosed its roadmap for a digital euro project on 24 July, the People’s Bank of China (PBoC) published a white paper describing the advancements of its plan for a digital yuan (e-CNY).

While the EU roadmap outlines an investigation phase which will end in five years, China has already introduced several pilot experiments for its e-CNY. In June 2021, the e-CNY was employed in more than 70.7 million transactions for a value of 34.5 billion yuan by 20.8 million retail users and 3.5 million corporate users.[1]

In the battleground of global digital competition, countries seek first-mover advantage to set standards and foster a model of development. As suggested by ECB economists,[2] this assumption could also be relevant in the event that a national central bank digital currency (CBDC) is launched, helping to explain why countries seem to be racing over the launch of public digital currencies. Unsurprisingly, the geostrategic dimension behind a CBDC is highly emphasised in the political narrative of all major powers. With the growing digitalisation of the economy, a CBDC is seen as a tool to mitigate risks related to the emergence of new privately-owned digital currencies and of foreign CBDCs.[3]

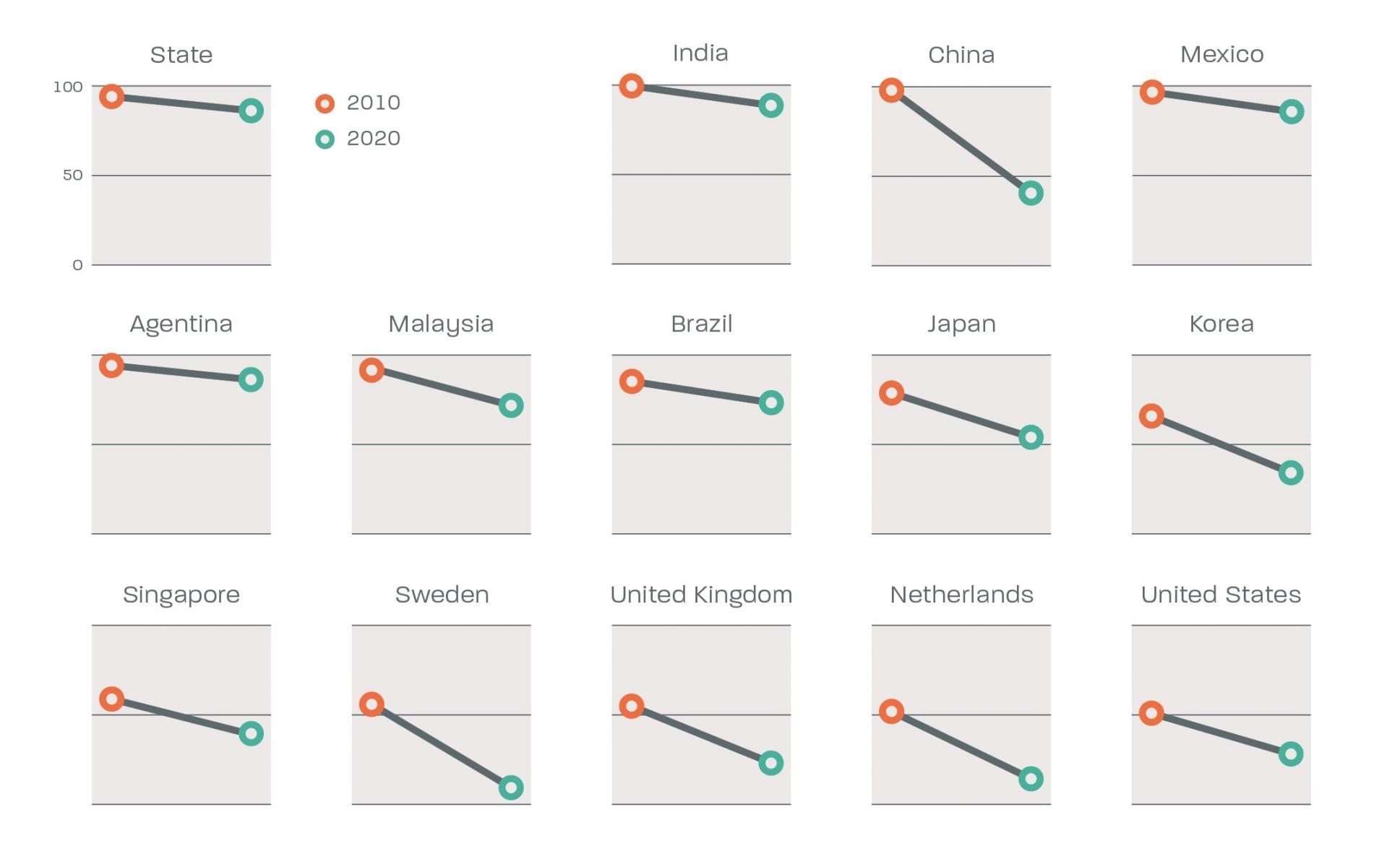

Strongly incentivised by domestic and external factors, China is leading the race for a national CBDC. Its payment market is already extremely digitalised. The number and value of mobile payment transactions accounted for 66 per cent and 59 per cent of total payment transactions in 2019 while cash-based transactions were only 23 per cent and 16 per cent respectively.[4] Nevertheless, around 92 per cent of mobile payments were made through only two private providers – WeChat Pay (39 per cent) and Alipay (53 per cent)[5] – which are integrated in much larger and diversified ecosystems associated to the Chinese Big Techs Tencent and Alibaba.

Their dominant position in the payment industry poses several concerns on systemic relevance, market power and anticompetitive use of data.[6] The issuing of a CBDC is seen by Beijing as a means to make the PBoC regain centrality in a digitalised economy. Furthermore, the e-CNY could undermine any future private digital currency project issued by foreign corporations – such as Facebook’s Diem, formerly known as Libra – which is perceived as a threat by the Chinese government.

Figure 1 | Cash usage by country (% total transactions by volume)

Source: Author’s elaboration from McKinsey, The 2020 McKinsey Global Payment Report, October 2020, https://www.mckinsey.com/~/media/mckinsey/industries/financial%20services/our%20insights/accelerating%20winds%20of%20change%20in%20global%20payments/2020-mckinsey-global-payments-report-vf.pdf.

The domestic use of a CBDC is however just one piece of a broader puzzle.

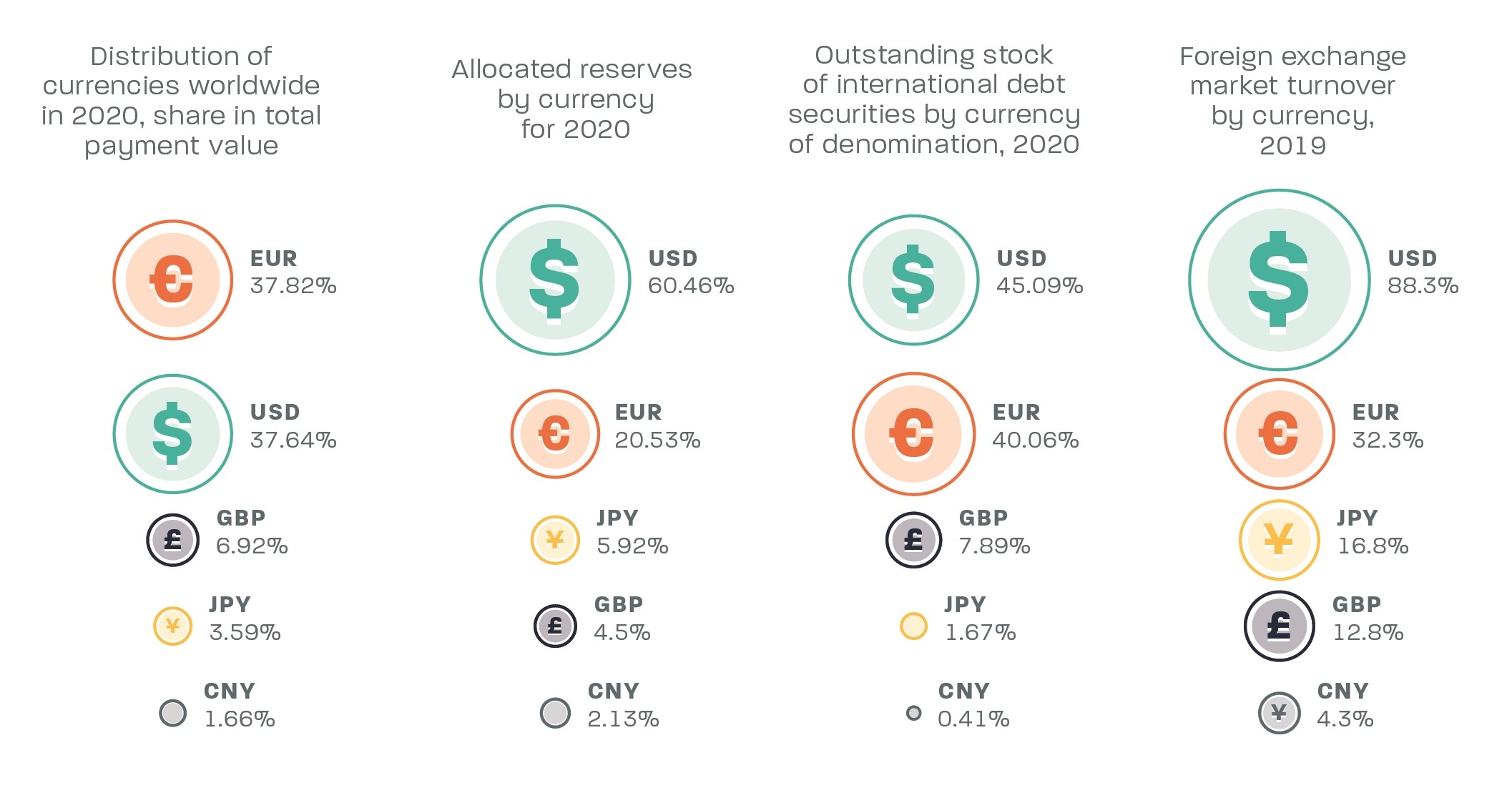

For the Chinese government, the e-CNY has the potential to pursue Beijing’s ambition to further internationalise its currency. Compared to China’s economic power, the yuan significantly underperforms as an international currency, making Beijing highly depended on the US dollar for global trade and investment.

For example, in January 2021, only 2.42 per cent of the total value of global payments were made in yuan.[7] As noted in a recent report from the Bank of China, Beijing should strategically reduce its exposure to the US dollar in view of a scenario in which the US could cut off access to dollar settlements for certain Chinese banks as retaliation for the deterioration of US–China relations.[8]

Figure 2 | Distribution of currencies in 2020

Source: Author’s elaboration from Statista, Distribution of Currencies Worldwide in 2020, Based on Their Transaction Value, https://www.statista.com/statistics/1189498.

After having failed to establish an alternative to the western-centric Society for Worldwide Interbank Financial Telecommunication (SWIFT) with the Cross-Border Inter-Bank Payments System (CIPS), multi-CBDC arrangements could allow China to circumvent the current system. This could allow to bypass the SWIFT intermediary node – if enough countries accept international payments in digital yuan – and, ultimately, defuse the reach and effectiveness of US primary and secondary sanctions.[9]

This scenario has alarmed many in the US who note that a digital yuan could be a national security issue,[10] while others have highlighted its challenge to any further internationalisation of the euro.[11] The e-CNY could indeed potentially provide a simplified method for cross-border yuan-denominated settlements, reducing costs and political risks associated with US dollar intermediation.

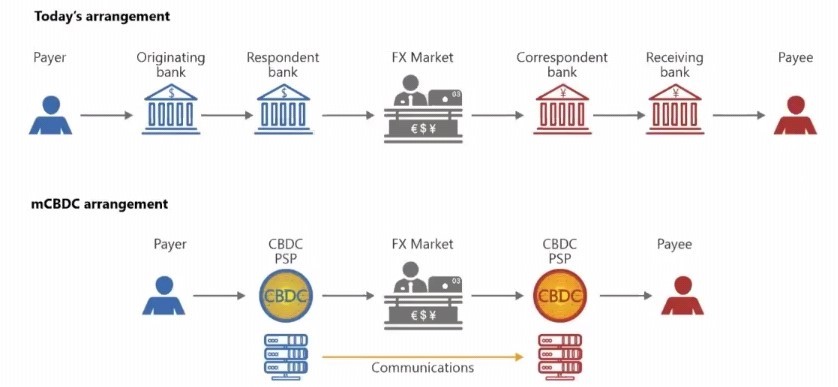

Digital networks and multi-CBDC arrangements could indeed ease the internationalisation of a currency as a mean of payment trough trade links. Economic theory suggest that frictions cause agents to use a specific national currency as international mediums and the economy of scale leads to concentrate on only a few national currencies for this purpose.[12]

A CBDC system could reduce frictions – transaction costs and costs of calculation – in principle, allowing retail and corporate users to have direct claims on central bank money.[13] As acknowledged by a recent report produced by the Bank for International Settlement, the Committee on Payments and Market Infrastructures, the World Bank and the International Monetary Fund, multi-CBDCs arrangements have the potential to enhance efficiency while lowering costs of cross-border transactions.[14]

Figure 3 | CBDCs vs today’s arrangements in cross-border transactions

Source: Author’s elaboration from BIS, “CBDCs: An Opportunity for the Monetary System”, cit.

Improving the global reserve status of a currency through a CBDC could instead be more challenging.[15] Recent research stresses that a currency’s role as an invoicing or payment unit acts as a complement to its role as a store of value, resulting in positive feedback loops.[16] For example, it has been suggested that a CBDC could facilitate the digitalisation of information exchanges in payments through e-invoices, e-receipts, e-identity and e-signature, potentially connecting a CBDC system with higher value services provided at a lower cost.

Nevertheless, the appeal of an international currency depends on economic and institutional factors – such as overall macroeconomic conditions, the openness and transparency of the issuing financial markets or the credibility of the issuing country’s social institutions. These determinants are currently constraining the yuan’s potential international status. As suggested by one study, policy and institutional factors (like capital account control, limited convertibility or economic freedom) are dragging down the potential share of the yuan in global reserves from 10 per cent of the total to 2 per cent.[17]

A Chinese CBDC is unlikely to alter these fundamental factors.

Without being accompanied by structural domestic reforms, the e-CNY will not be able to challenge the US dollars international status neither as a means of payment nor as a store of value or a unit of account.

Nevertheless, there is a bigger picture.

As suggested by a bourgeoning literature, the international status of a currency is also driven by essential and underpinning geopolitical factors which could influence the adoption of the e-CNY.[18] First, a digital yuan could strengthen the adoption of the yuan into cross-border payments, linking the e-CNY with various forms of economic activities through bilateral, regional and multilateral trade agreements, especially for those countries already involved in China’s trade-backed programmes (such as the Belt and Road Initiative).

Furthermore, the e-CNY project is pushing other major economies to accelerate their own national CBDC projects, as demonstrated by the ECB decision. Competitor countries aim to prevent the issuance of foreign CBDCs, as this could improve the status of other international currencies at the expense of theirs. If several national CBDCs are developed, bilateral and multilateral CBDC-arrangements can promote the establishment of a new payment system network based on multi-CBDCs arrangements in which exchange risks are drastically reduced and nodes are more independent from the US dollar.

However, to enable this potential, there is the need of some degree of cooperation to design interoperability between CBDC systems. Much of the international adoption of a national CBDC abroad will depend on agreed and shared standards and solutions.[19] While a bilateral solution between two countries could work, it is unlikely to be scalable, and to be applied globally. What is instead needed is a multilateral or regional arrangement that enables payments to be made in a frictionless form.

Being aware of this, Beijing is active in trying to build international cooperation around its CBDC project, seeking to exploit its first-mover advantage. The PBoC has already proposed a set of global rules to empower basic interoperability between CBDCs issued by different jurisdictions.[20] Moreover, it has joined the m-CBDC Bridge initiative – a CBDC cross-border payment project – together with the BIS Innovation Lab, the Bank of Thailand, the Hong Kong Monetary Authority and the Central Bank of the United Arab Emirates.[21]

Finally, SWIFT, concerned about a potential loss of access to the Chinese economy, has set up a joint venture, called Finance Gateway Information Services, with the PBoC to improve cross-border transaction services in China. Three per cent of the joint venture is owned by the PBoC’s Digital Currency Research Institute, suggesting there is further scope to globally promote the use of the digital yuan.[22]

Transformations in the international monetary system are historically slow. A CBDC is unlikely to qualitatively change the economic and institutional factors that affect the international use of currencies.[23] e-CNY’s policy goal, however, does not seek to supplant the US dollar as the dominant global currency, instead, it aims to reduce dollar dependence with the establishment of a new and alternative payment system. To push this (more feasible) agenda, China can successfully leverage its global economic power to shape and foster the international, or at least multilateral, CBDC space.

The e-CNY will not ultimately become a silver bullet for the ambition of an international yuan. However, with the digital euro and the digital US dollar initiatives lagging far behind, China appears to have little competition in the CBDC space. While for the euro and the US dollar it is more important to get their CBDC projects right than to rush these into fruition, the EU and the US risk losing momentum and leaving China with great influence over the development of global CDBC standards.

Nicola Bilotta is Researcher at the Istituto Affari Internazionali (IAI) where he works on international political economy, digital economy and geofinance.

[1] People’s Bank of China, Progress of Research & Development of E-CNY in China, July 2021, http://www.pbc.gov.cn/en/3688110/3688172/4157443/4293696/2021071614584691871.pdf.

[2] Massimo Minesso Ferrari, Arnaud Mehl and Livio Stracca, “The International Dimension of a Central Bank Digital Currencies”, in VoxEU, 12 October 2020, https://voxeu.org/node/66335.

[3] See for example: Fabio Panetta, A Digital Euro for the Digital Era, Introductory statement at the ECON Committee of the European Parliament, Frankfurt am Main, 12 October 2020, https://www.bis.org/review/r201013a.pdf.

[4] People’s Bank of China, Progress of Research & Development of E-CNY in China, cit., p. 2.

[5] Cecily Liu and Wang Mingjie, “New Ways to Pay Make Life Easier on the Road”, in China Daily, 19 October 2018, https://www.chinadaily.com.cn/a/201810/19/WS5bc93a59a310eff303283525.html.

[6] Bank for International Settlements (BIS), “Big Tech in Finance: Opportunities and Risks”, in BIS Annual Economic Report 2019, June 2019, p. 70, https://www.bis.org/publ/arpdf/ar2019e3.htm.

[7] See RMB Tracker, Monthly Reporting and Statistics on Yuan (RMB) Progress towards Becoming an International Currency, February 2021, p. 3, https://www.swift.com/swift-resource/250281/download.

[8] “Chinese Banks Urged to Switch Away from SWIFT as U.S. Sanctions Loom”, in Reuters, 29 July 2020, https://reut.rs/309S59u.

[9] See Jan Knoerich, “China’s New Digital Currency: Implications for Yuan Internationalization and the US Dollar”, in Nicola Bilotta and Fabrizio Botti (eds), The (Near) Future of Central Bank Digital Currencies. Risks and Opportunities for the Global Economy and Society, Bern, Peter Lang, 2021, p. 160, https://www.peterlang.com/document/1068992.

[10] Yaya J. Fanusie and Emily Jin, China’s Digital Currency. Adding Financial Data to Digital Authoritarianism, Center for a New American Security, January 2021, p. 16, https://www.cnas.org/publications/reports/chinas-digital-currency; Frederick Kempe, “Why the US Can’t Afford to Fall Behind in the Global Digital Currency Race”, in Atlantic Council Inflection Points, 28 February 2021, https://www.atlanticcouncil.org/?p=358914.

[11] Carolynn Look, “China’s Digital Yuan Is Key Risk for Euro, ECB’s Villeroy Says”, in Bloomberg, 29 June 2021, https://www.bloomberg.com/news/articles/2021-06-29/china-s-digital-yuan-is-key-risk-for-euro-ecb-s-villeroy-says.

[12] Paul Krugman, “The International Role of the Dollar: Theory and Prospect”, in John F.O. Bilson and Richard C. Marston (eds), Exchange Rate Theory and Practice, Chicago/London, University of Chicago Press, 1984, p. 261-278, http://www.nber.org/chapters/c6838.

[13] Bank for International Settlements (BIS), “CBDCs: An Opportunity for the Monetary System”, in BIS Annual Economic Report 2021, June 2021, p. 65-95, https://www.bis.org/publ/arpdf/ar2021e3.htm.

[14] BIS et al., Central Bank Digital Currencies for Cross-Border Payments: Report to the G20, July 2021, https://www.bis.org/publ/othp38.htm.

[15] Markus K. Brunnermeier, Harold James and Jean-Pierre Landau, “The Digitalization of Money”, in NBER Working Papers, No. 26300 (September 2019), https://www.nber.org/papers/w26300.

[16] Massimo Ferrari and Arnaud Mehl, “Central Bank Digital Currency and Global Currencies”, in European Central Bank (ECB), The International Role of the Euro, Frankfurt amd Main, ECB, June 2021, p. 55-60, https://www.ecb.europa.eu/pub/ire/html/ecb.ire202106~a058f84c61.en.html#toc18.

[17] Yiping Huang, Daili Wang and Gang Fan, “Paths to a Reserve Currency: Internationalization of the Renminbi and Its Implications”, in ADBI Working Papers, No. 482 (May 2014), https://hdl.handle.net/11540/1244.

[18] See Barry Eichengreen, Arnaud Mehl and Livia Chiţu, “Mars or Mercury? The Geopolitics of International Currency Choice”, in VoxEU, 2 January 2018, https://voxeu.org/node/62433.

[19] Such as: (i) the ability to carry data about the payment in a standardised form; (ii) identity requirements and checks; (iii) application of fraud prevention, Know Your Customer (KYC), Anti-Money Laundering (AML), security, integrity, transparency, data privacy.

[20] Tom Wilson and Marc Jones, “China Proposes Global Rules for Central Bank Digital Currencies”, in Reuters, 25 March 2021, https://reut.rs/3si5OH4.

[21] BIS, Central Banks of China and United Arab Emirates Join Digital Currency Project for Cross-Border Payments, 23 February 2021, https://www.bis.org/press/p210223.htm.

[22] “SWIFT Sets Up JV With China’s Central Bank”, in Reuters, 4 February 2021, https://reut.rs/3cDqynA.

[23] Dong He et al., “Digital Money Across Borders: Macrofinancial Implications”, in IMF Policy Papers, No. 2020/50 (October 2020), https://www.imf.org/en/Publications/Policy-Papers/Issues/2020/10/17/Digital-Money-Across-Borders-Macro-Financial-Implications-49823.

-

Details

Rome, IAI, October 2021, 7 p. -

In:

-

Issue

21|44