This Time is Different. The "COVID-Shock" and Future of the Global Oil Market

This Time is Different. The “COVID-Shock” and Future of the Global Oil Market

Giuliano Garavini*

Oil markets are facing a perfect storm. The scissors of supply and demand are moving against one another, generating increasing pain on the oil industry and the political and financial stability of oil-producing countries.

Global oil demand is dropping due to the recession induced by the COVID-19 shut down of economic activity and transport in the most industrialized countries. Goldman Sachs predicts that global demand could drop from 100 million barrels per day (mdb) in 2019 to nearly 80 mdb in 2020.[1] If confirmed, this would be single biggest demand shock since petroleum started its race to become the most important energy source in the world.

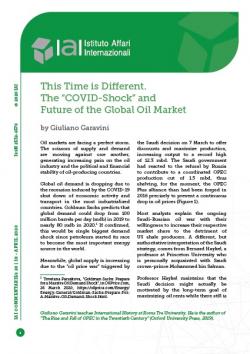

Meanwhile, global supply is increasing due to the “oil price war” triggered by the Saudi decision on 7 March to offer discounts and maximize production, increasing output to a record high of 12.3 mbd. The Saudi government had reacted to the refusal by Russia to contribute to a coordinated OPEC production cut of 1.5 mbd, thus shelving, for the moment, the OPEC Plus alliance than had been forged in 2016 precisely to prevent a continuous drop in oil prices (Figure 1).

Figure 1 | OPEC oil production and supply adjustments

Source: Abigail Ng, “5 Charts that Explain the Saudi Arabia-Russia Oil Price War So Far”, in CNBC, 1 April 2020,

https://www.cnbc.com/2020/04/01/5-charts-that-explain-the-saudi-arabia-russia-oil-price-war-so-far.html.

Most analysts explain the ongoing Saudi-Russian oil war with their willingness to increase their respective market share to the detriment of US shale producers. A different, but authoritative interpretation of the Saudi strategy, comes from Bernard Haykel, a professor at Princeton University who is personally acquainted with Saudi crown-prince Mohammed bin Salman.

Professor Haykel maintains that the Saudi decision might actually be motivated by the long-term goal of maximizing oil rents while there still is a market for Saudi oil “because climate change has fueled a global push toward de-carbonization and renewable energy”.[2]

In the short-term, the Saudi leadership is probably seeking to bring Russia back in line with OPEC while at the same time punishing US shale producers which rely on higher oil prices for commercial viability. Yet, Riyadh is also pursuing a longer-term goal, which entails producing as much oil as possible for a world that will be less reliant on petroleum in the medium term.

There is an inherent contradiction between the two goals stated above and the need for Saudi Arabia to preserve a relatively high oil price in order to guarantee fiscal income for the state, thus providing adequate welfare to its citizens.

As a result of the twin supply and demand shocks, the price of US oil (West Texas Intermediate – WTI) has dropped below 20 dollars a barrel followed by wild oscillations. At this price, most US shale companies will not be profitable, (only 3 US shale companies have an average breakeven cost at 30 dollars), while certain qualities of US crude have been sold at negative prices.

The world’s most important crude benchmark (Brent), is below 30 dollars per barrel. With these prices, the political, social and economic turmoil already experienced by OPEC countries such as Venezuela, Libya, Algeria, Nigeria and Iran before the present crisis will become unbearable; while both Saudi Arabia (with a fiscal breakeven at 84 US dollars per barrel) and Russia (with its lower fiscal breakeven price at 48 US dollars) will face tremendous pressures.[3]

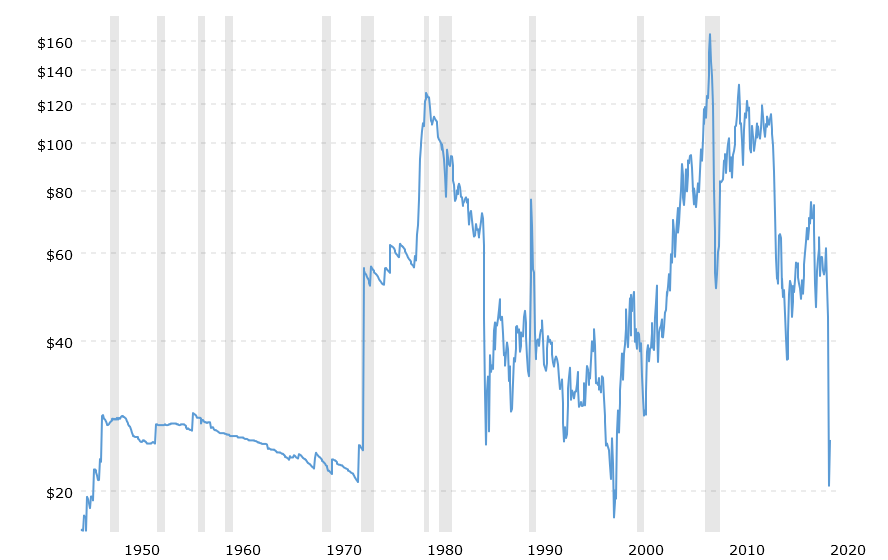

The present crisis holds numerous similarities with the oil “counter-shock” of 1985/86 (Figure 2).[4] At the time, global oil demand was declining due to the economic recession of the early 1980s, as well as to the introduction of efficiency measures and the shift to “alternative” energy sources (nuclear and natural gas) put in place by most OECD governments. Similarly to today, there was a problem of over-supply, due to the advent of new oil production, particularly from the British and Norwegian North Sea. Today, a large portion of new supply instead comes from the US shale industry, especially in the Permian Basin, that has increased US production from 5 mbd in 2008 to more than 12 mbd in 2019, giving rise to the so-called “shale revolution”.

Figure 2 | Crude oil price adjusted for inflation (WTI), 1946–2020

Source: MarcoTrends, Crude Oil Prices - 70 Year Historical Chart, https://www.macrotrends.net/1369/crude-oil-price-history-chart.

Like today, Saudi Arabia was fed up of being forced to continuously cut production to defend the OPEC price and, in the Autumn of 1985, decided to discipline non-OPEC producers by offering discounts and maximizing production. Oil prices fell to nearly 10 dollars a barrel as a result, having a terrible impact on oil producers. US “independent” producers faced bankruptcy, and the cycle of oil industry “mega-mergers” began. OPEC countries entered a phase of political and economic turmoil: Saddam Hussein’s ill-conceived gamble to revive a bankrupted Iraq by invading neighbouring Kuwait in 1990 was only the most evident consequence of the “counter-shock”.

Notwithstanding similarities between the “counter-shock” and the “COVID-shock”, differences are even more important. We might actually be witnessing the beginning of a new oil era.

The first novelty is that we might now have reached “peak oil demand” due to a combination of cultural, financial and political shifts in the largest industrialized countries, combined with the ever-increasing pressures for “deglobalization”, heightened by the recent shock from the global pandemic.[5] While the price “counter-shock” of 1985/86 led to a massive expansion of global oil consumption that fuelled the neoliberal globalization of the 1990 and 2000s (global oil consumption increased from 60 mbd in 1985 to 100 mbd in 2019), it is unlikely that the price shock of 2020 will bring global oil demand back beyond the peak of 100 mbd. This will be especially true if state investment plans to counteract the COVID-19 induced recession will be also oriented toward boosting “green” technologies and infrastructures.

The other novelty is that most OPEC countries, and crucially the two countries that played a key role for the creation of OPEC, Venezuela and Saudi Arabia, are for different reasons shifting from a “political approach” to oil production, to a prevailingly “commercial approach”. The Venezuelan government has essentially lost control over its oil industry – which has been effectively privatized and controlled by foreign, mostly Russian, companies. Saudi Arabia has taken the unprecedented step to market 1.5 per cent of its national oil company Saudi Aramco, and as a result now needs to consistently produce dividends for its shareholders, even if at the expense of Saudi state finances.

The spread of this “commercial approach” by OPEC national oil companies will not allow for significant structural production cuts in a competitive environment. Nor will it allow for strong international cooperation with a focus on preserving oil rents for OPEC governments and protecting the availability of the natural resources for future generations. National companies will be struggling to defend their market share, and will thus offer discounts to their customers and demand fiscal incentives from their governments.

The combined pressures from the new “peak demand” scenario, together with the weakening of OPEC due to the commercial orientation of national oil companies, will basically wipe out whatever was left of a “structure” of the oil market that has become increasingly unstable since the 1970s. The race to the bottom of oil prices will wreak economic havoc on most oil-producing countries and regions of the world, including on US states such as Texas (where the oil industry represents 10 per cent of the GDP and directly employs 360,000 workers), and on high-cost OECD oil producers such as Canada.

Since the 1970s, OPEC has been the only international organization that, with moderate success, has attempted to control production and stabilize prices. It cannot, and will not, continue doing so any longer. It will not accept to rein in production while the rest of the world simply strives to pump out as much oil and gas as possible, be this from shale formations, from tar sands or from below the Arctic, with utter lack of environmental concerns. Oil production cuts will either be shared and coordinated with other world producers, or they will simply not happen.

John Maynard Keynes had repeatedly warned about the need for global management to stabilize the price of commodities.[6] The only precedent for global negotiations on energy prices has been the Conference for International Economic Cooperation (CIEC) held in Paris from 1975 to 1977. At the time, a select group of 27 participants from the OECD, OPEC and the “less developed countries” tried to discuss energy prices and development issues in parallel. The danger stemmed from soaring oil prices and the widespread fear of “running out of oil”. The exercise ended in failure because of the unwillingness of OPEC, then at the peak of its power, to discuss prices without relevant concessions by industrialized countries.

This time is different. The risk and instability derive from peak oil demand, low prices and the need for stable prices in order to plan a speedy transition away from fossil fuels, while avoiding the political and economic collapse of oil-producing countries. A new “pro-rationing” effort must be undertaken at a global level, involving the US and other OECD members, OPEC and non-OPEC states such as Russia, Mexico and Brazil. Significantly, the “pro-rationing” conducted by the Texas Railroad Commission in the 1930s already served as the model for the founders of OPEC.

Whatever its format and however difficult it may be to change a “neoliberal” ideology that rules out state-led regulation of production, the time for a global dialogue on production levels and oil prices (and possibly on environments standards) has come. Deregulation of the energy market has to give way to a new era of regulation of the oil industry at both national and international levels.

The alternative will leave commercially-oriented oil companies, both national and international, free to engage in a destructive price war that will maximize environmental degradation and the squandering of natural resources. A destructive price-war will ultimately endanger decarbonization efforts (car-markers are already pressing governments to relax emissions standards), and will increase political and economic instability in OPEC countries, such as Saudi Arabia and Iran, that are key regional actors.

* Giuliano Garavini teaches International History at Roma Tre University. He is the author of “The Rise and Fall of OPEC in the Twentieth Century” (Oxford University Press, 2019).

[1] Tsvetana Paraskova, “Goldman Sachs: Prepare for a Massive Oil Demand Shock”, in OilPrice.com, 26 March 2020, https://oilprice.com/Energy/Energy-General/Goldman-Sachs-Prepare-For-A-Massive-Oil-Demand-Shock.html.

[2] Bernard Haykel, “Saudi Arabia’s Radical New Oil Strategy”, in Project Syndicate, 23 March 2020, https://prosyn.org/LmBSCnq.

[3] Jack Farchy and Paul Wallace, “Petrostates Hammered by Oil Price Plunge and Pandemic’s Spread”, in Bloomberg, 28 March 2020, https://www.bloomberg.com/news/articles/2020-03-28/petrostates-hammered-by-oil-price-plunge-and-pandemic-s-spread.

[4] Duccio Basosi, Giuliano Garavini and Massimiliano Trentin (eds), Counter-Shock. The Oil Counter-Revolution of the 1980s, London/New York, IB Tauris, 2018.

[5] The debate on “peak demand” has been raging since 2018. See Spencer Dale and Bassam Fattouh, “Peak Oil Demand and Long-Run Oil Prices”, in OIES Energy Insights, No. 25 (January 2018), https://www.oxfordenergy.org/?p=30822.

[6] See Robert W. Dimand and Mary Ann Dimand, “J.M. Keynes on Buffer Stocks and Commodity Price Stabilization”, in John Cunningham Wood (ed.), John Maynard Keynes. Critical Assessments, Second Series, Vol. VIII, London/New York, Routledge, 1994, p. 87.

-

Details

Rome, IAI, April 2020, 6 p. -

In:

-

Issue

20|18