China's Global Ambitions and the MENA Region: A Focus on the Energy Sector

China’s Global Ambitions and the MENA Region: A Focus on the Energy Sector

Alice Vanni*

China’s growing clout and international ambitions are well known. Spurred by major region-wide infrastructure projects and multibillion investments in train, road and port facilities spanning multiple continents, China’s global strategy is attracting increased attention since the formal unveiling of Beijing’s Belt and Road Initiative (BRI) in 2013.

The Middle East and North Africa (MENA) is set to occupy an important dimension in China’s international ambitions. Like other global powers, China has long considered the Middle East a source of vital energy supplies. Benefitting from the US military umbrella and the free flow of oil from the Strait of Hormuz and other strategic passageways, China has thus far managed to establish important trade and energy relationships with a number of MENA states while keeping its political, military and diplomatic exposure to a minimum.

Beijing’s traditionally cautious approach may be shifting however. Driven by a mixture of domestic, foreign and regional trends, a number of important opportunities for China in the Middle East are slowing taking form. Beijing will increasingly look to the MENA not only as a key oil and gas supplier but also a crucial arena for its economic and trade ambitions, particularly in the renewable energy domain. The BRI will play a crucial role in this, both in terms of increased energy demands to complete the various stages of the project and as a key throughway for trade to and from Mainland China.

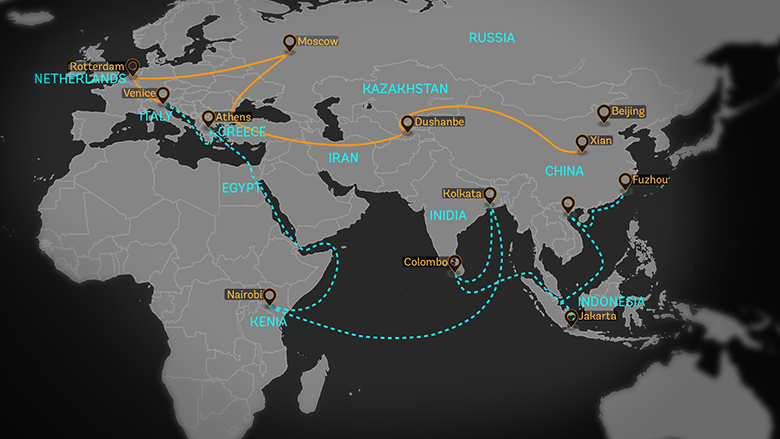

The BRI consists of two separated, but interconnected projects: the Silk Road Economic Belt, roughly spanning the Central Asian land route of the ancient Silk Road, and the Maritime Silk Road, which instead comprises the sea lane route from the South China Sea to the Indian Ocean and the Suez Canal all the way to the Mediterranean Sea (see Figure 1). The goal is that of creating a more cohesive economic network of infrastructure, roads, train links and cultural exchanges aimed at boosting land and sea trade to and from Mainland China.

Figure 1 | The Belt and Road Initiative

Source: World Bank website: Belt and Road Initiative, https://goo.gl/SoZDMf.

Funds earmarked by China for the BRI are indeed impressive. The Asian Infrastructure Investment Bank (AIIB), a multilateral development bank established in late 2015 and headquartered in Beijing, has been endowed with 100 billion US dollars in funds (of which 50 billion by China, 8.4 billion by India and the rest by the other members),[1] while the Silk Road Fund disposes of a further 40 billion US dollars to be invested abroad.

As of today, 10 out 87 members of AIIB are from the MENA region,[2] to which China has pledged to provide at least 20 billion US dollars in loans and 106 million in financial aid. Concretely, this aid includes outstanding pledges of 15 million US dollars for Palestine and a further 91 million for Jordan, Lebanon, Syria and Yemen.[3] China invested 29.5 billion US dollars in MENA countries in 2016, accounting for 31.9 per cent of total FDI flows into the region.[4]

While benefitting from a rather diversified energy import mix, MENA states do stand out as among China’s most important suppliers of crude oil, particularly Saudi Arabia, Iraq, Iran, Oman and Kuwait. Aside from imports, Chinese national oil companies have also acquired shares in foreign oil companies. Indeed, Chinese companies nowadays tend to be directly involved in the production of a large part of the oil it imports from Iraq, Iran, Russia and Angola.[5]

Over the past decades, the major destinations for Chinese FDIs in the MENA energy sector were Iran and Iraq. Today, a greater openness in the Persian Gulf and North Africa is also taking shape. While Beijing is excluded from directly participating in Saudi oil production, energy relations with the Kingdom have expanded considerably since 2005, with Saudi Arabia emerging as China’s second most important oil supplier after Russia. Moreover, recent reports have indicated that the China Investment Corp and the China National Petroleum Corporation (CNPC) are seeking to become leading investors in the Kingdom’s national oil company, Saudi Aramco.[6]

China’s standing has also been strengthened by the US’s unilateral withdrawal from the Paris Agreement on climate change in June 2017. Beijing has since emerged as a lead international actor on climate change, not only in its capacity as the world’s largest emitter of fossil fuels but also as the largest investor in sustainable energy infrastructure. While some have questioned the compatibility of the BRI with China’s Paris Agreement commitments,[7] few doubt that China’s growing investments in green energy may provide Beijing with a further boost in its global ambitions.

Solar energy, in particular, represents a key sector for future growth, especially among Gulf Cooperation Council (GCC) countries, which enjoy over 3,000 hours of sunlight per year.[8] Last April, for instance, the Shanghai Electric Generation Group (SECG) signed an agreement with the Dubai Electricity and Water Authority (DEWA) to build part of the Mohammed bin Rashid solar park in the UAE, the largest thermo-solar power plant under construction in the world.[9]

During a time when the US’s standing is increasingly challenged, both in the region and internationally, China is hesitantly demonstrating increased interest in geopolitical and security issues in the MENA region. Examples include cautious efforts to advance Israeli-Palestinian dialogue,[10] uncorroborated reports of Beijing’s military advisors aiding Russian and Syrian forces in Syria[11] and efforts to position China as a key contributor (and beneficiary) in the reconstruction of Syria and Iraq.[12]

Recent reports of increased Chinese military ships in the Malacca straits and the opening of Beijing’s first overseas military base in Djibouti are also creating concern among Western strategic communities.[13] Further reports that the Shanghai International Port Group will begin operating the commercial port in Haifa by 2021[14] are only the most recent example of this expanding Chinese presence in the MENA region. Indeed, the BRI involves crucial projects in a number of important ports of the region such as Suez and Djibouti, while further projects are planned in Aden, Abu Dhabi and Massawa in Eritrea.

China is not (yet) a global military actor, but the more its economic interests expand, the more responsibilities Beijing will have to shoulder. This will in turn increase risks to Chinese investments and interests that will demand action in the diplomatic and political realm as well, possibly leading Beijing to shed some of its traditional caution and engage in more proactive role in the region.

What this will entail for China’s role in the MENA region remains an open question. What is clear, however, is that a number of MENA states are increasingly looking to China as a valuable source of investments and a key partner to help in their complex economic, energy and political transitions.

Given Beijing’s hesitant alignment with Russia and its important economic interests in Iran and Iraq, one may predict increased tensions with the US administration, with which a trade war has already begun. If this is indeed the case the MENA region will be headed for a new period of great power rivalry and competition with adverse effects on regional stability and intra-state relations. It will also mean that China will need to become more directly engaged in the region’s many conflicts and crises, shedding some of it’s traditional caution as Beijing moves to add political, diplomatic and even military backing to it’s growing economic interests in the Middle East and North Africa.

* Alice Vanni is a MA student at the Ca’ Foscari University in Venice and a former intern at the Istituto Affari Internazionali (IAI).

[1] Martin A. Weiss, “Asian Infrastructure Investment Bank (AIIB)”, in CRS Reports, No. R44754 (3 February 2017), https://fas.org/sgp/crs/row/R44754.pdf.

[2] Bahrain, Egypt, Iran, Israel, Jordan, Lebanon, Oman, Qatar, Saudi Arabia, United Arab Emirates.

[3] “China’s Xi Pledges $20 Billion in Loans to Revive Middle East”, in Reuters, 10 July 2018, https://reut.rs/2N4DlzJ.

[4] “China Becomes Principal Investor in Middle East as B&R Brings New Opportunities”, in Xinhua Silk Road Information Service, 9 August 2017, http://en.silkroad.news.cn/2017/0809/59007.shtml.

[5] Michal Meidan, “China’s Loans for Oil: Asset or Liability?”, in OIES Papers, No. WPM 70 (December 2016), p. 3, https://doi.org/10.26889/9781784670733.

[6] Robert Mills, “China’s Big Play for Middle East Oil”, in Bloomberg, 10 May 2017.

[7] Lili Pike, “Is the Belt and Road compatible with Paris?”, in China Dialogue, 12 December 2017, https://www.chinadialogue.net/article/show/single/en/10284.

[8] Makio Yamada, “GCC-East Asia Relations in the Fields of Nuclear and Renewable Energy: Opportunities and Barriers”, in OIES Papers, No. MEP 14 (September 2016), p. 21, https://doi.org/10.26889/9781784670672.

[9] ACWA Power, EPC Contract with Shanghai Electric to Develop 700 MW DEWA CSP Project Signed in China, 15 April 2018, http://www.acwapower.com/en/newsroom/press-releases/latest-news/epc-contract-with-shanghai-electric-to-develop-700-mw-dewa-csp-project-signed-in-china.

[10] Guy Burton, “China, Jerusalem and the Israeli-Palestinian Conflict”, in Middle East Institute Articles, 20 February 2018, https://www.mei.edu/node/44340.

[11] Logan Pauely and Jesse Marks, “Is China Increasing Its Military Presence in Syria?”, in The Diplomat, 20 August 2018, https://thediplomat.com/?p=141185.

[12] Jesse Marks, “In the Competition over Syria’s Reconstruction, China Is the Likely Winner”, in Defense One, 2 March 2018, https://www.defenseone.com/ideas/2018/03/competition-over-syrias-reconstruction-china-likely-winner/146366; Richard Wachman, “China Pushes for Bigger Role in Iraqi Reconstruction”, in Arab News, 3 March 2018, http://www.arabnews.com/node/1257811.

[13] David Tweed and Adrian Leung, “China Is Making a Bold Military Power Play”, in Bloomberg, 6 March 2018, https://www.bloomberg.com/graphics/2018-china-navy-bases.

[14] David Brennan, “Chinese Deal to Take Over Key Israeli Port May Threaten U.S. Naval Operations, Critics Say”, in Newsweek, 14 September 2018, https://www.newsweek.com/chinese-deal-take-over-key-israeli-port-may-threaten-us-naval-operations-1121780.

-

Dati bibliografici

Roma, IAI, settembre 2018, 4 p. -

In:

-

Numero

18|54