Deal or No-Deal? Beyond the Hype on Ukraine Gas Transit Negotiations

Deal or No-Deal? Beyond the Hype on Ukraine Gas Transit Negotiations

Danila Bochkarev*

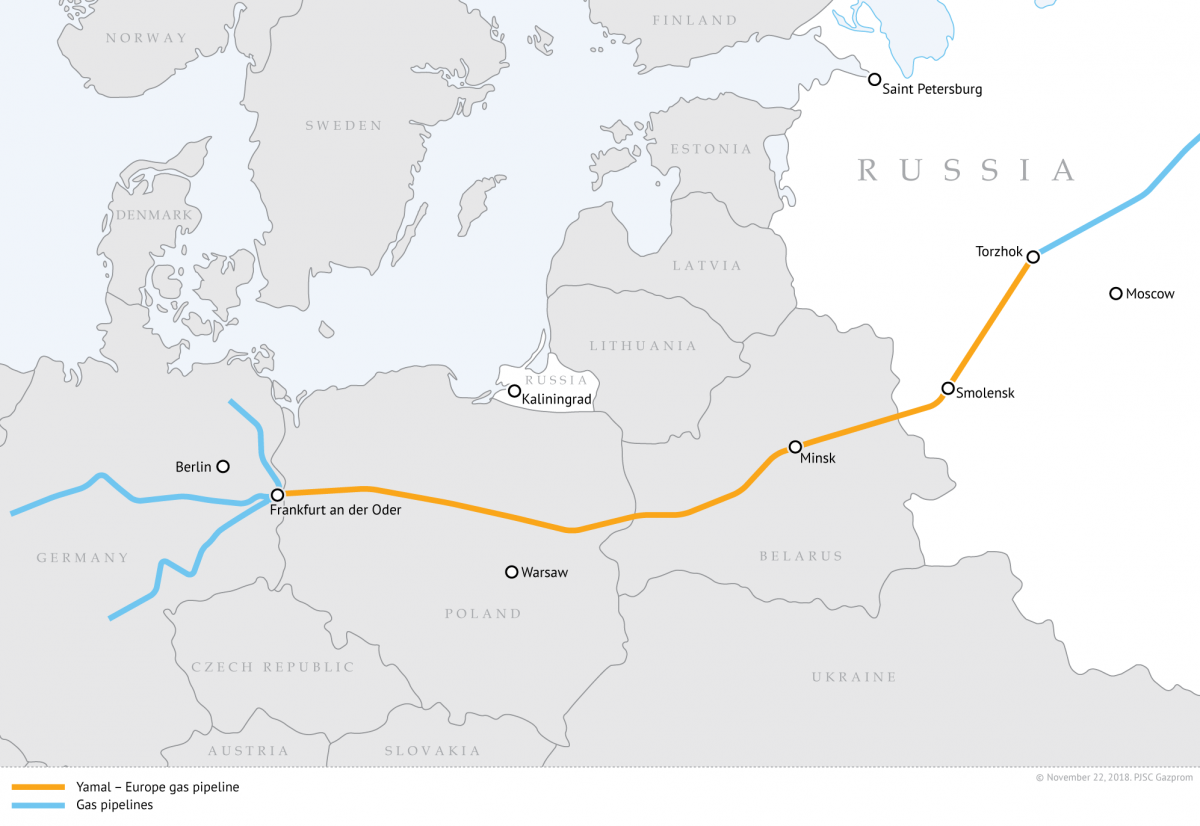

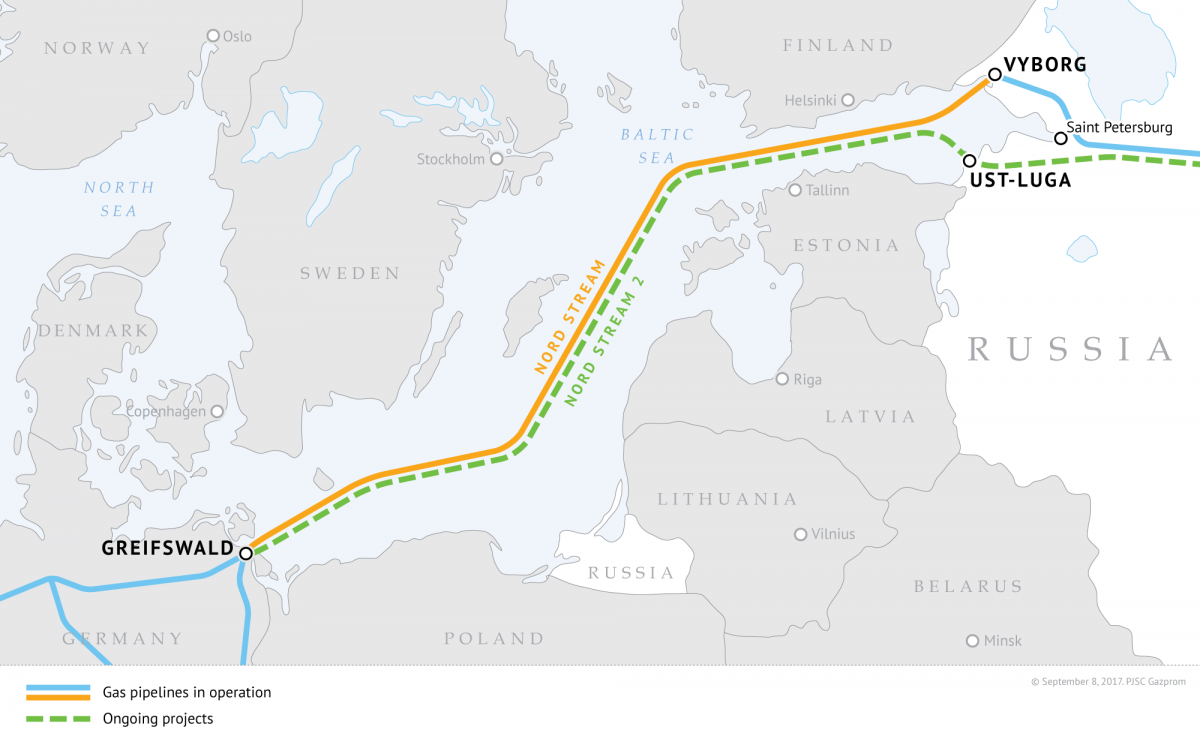

Ukraine has traditionally been the key transit corridor for Russian gas exported to Europe. Following the construction of new pipeline routes – Yamal-Europe, Nord Stream and “Blue Stream” (see Figures 1–3) – the share of Ukraine’s transit decreased.[1]

The current transit contract between Russia’s Gazprom and Ukraine’s Naftogaz expires at the end of 2019. Ongoing negotiations are not making much progress with political transitions and unrealistic negotiating positions contributing to the delay.

The media has often portrayed a no-deal scenario as an apocalypse. This is far from reality. Gas transit via Ukraine currently represents over 16 per cent of the EU’s total natural gas consumption and Ukraine is likely to remain a strategic passageway for European gas looking into the future. Furthermore, the absence of a transit deal would not necessarily mean the cessation of physical flows via Ukraine, at least in the short-to-medium term.

A precedent for a no-deal transit exists: Gazprom’s deliveries to Armenia via Georgia continued in the absence of a transit contract.[2] Furthermore, according to the stress tests conducted in 2017 by the European Network of Transmission System Operators for Gas, only Bulgaria would need to significantly curtail natural gas demand in the event of a total supply cut via Ukraine during the winter months (January–February), when energy demands are the highest.

Figure 1 | Yamal-Europe Route

Source: Gazprom website: Yamal – Europe, https://www.gazprom.com/projects/yamal-europe.

Figure 2 | Blue Stream and TurkStream Routes

Source: Gazprom website: TurkStream, https://www.gazprom.com/projects/turk-stream.

Figure 3 | Nord Stream 1 and 2 Route

Source: Gazprom website: Nord Stream, https://www.gazprom.com/projects/nord-stream.

Moreover, Ukraine has pledged to fully implement EU energy rules which should allow Gazprom – or other energy companies – to book Ukraine’s pipeline capacities for a short period of time without signing a special transit agreement. Last but not least, a number of alternative routes that bypass Ukraine are being build. So, why is there such concern surrounding the Ukraine–Russia transit talks and the possibility of a no-deal?

At a first glance, the launch of the Nord Stream-2 – a pipeline going from Russia to Germany via the Baltic Sea and expected to be operational by December 2019 with a capacity of 55 billion cubic meters of gas per year (bcm/year) – and the TurkStream – a pipeline linking Russia and Turkey via the Black Sea that is expected to be operational by the end of 2019 and carries a capacity of 31 bcm/year – should drastically reduce Ukraine’s transit share (see Figures 2 and 3). This could make the Ukraine route obsolete, at least according to uninformed observers.

However, pipelines are not just about annual flows – daily capacity is of equal, if not more importance. Demand on the coldest day of the year can be over three times higher than demand on the warmest day. As a result, aggregate usage of the pipelines is likely to have “less than 100% utilisation over the year”.[3] Furthermore, with a full utilisation of non-Ukrainian routes during the peak periods, Ukraine will remain “the only transit route with spare capacity in times of peak winter demand”.[4]

According to Wood Mackenzie, Europe will need to import an additional 77 bcm by 2025 as a result of EU decarbonisation policies (often leading to an increase in consumption) and the fall in domestic gas production in Europe.[5] Decreased production is significantly impacted by the Dutch government’s decision to halt production by 2030 at Groningen, one of the EU’s largest gas fields. While liquefied natural gas (LNG) imports to the EU are on the rise, these will alone not be sufficient to meet increased demand. Additional pipeline imports from both the Caspian and Russia will thus be handy, increasing the need for Ukraine’s gas transportation system.

It is therefore clear that Ukraine’s pipeline system would not stay idle if reasonable transportation tariffs are on the table. While economics and energy demands justify the continuation of gas transits via Ukraine, politics and electoral cycles in Europe and Ukraine have adversely impacted the transit negotiations.

Trilateral gas talks between the EU, Ukraine and Russia held in Brussels this January showed how difficult it is to negotiate a sound market-based deal during political transitions and governmental changes in the EU and Ukraine. Furthermore, the present negotiations to appoint a new Commission in the wake of the May 2019 European elections might lead to the absence of a high-level EU negotiator with powers lasting beyond the end of the year.

Political developments in Ukraine are also constraining the negotiations, at least until the fall. In April 2019, political newcomer Vladimir Zelenski won presidential elections in Ukraine with a landslide, moving to call snap elections for 21 July. Zelenski’s party is expected to win the election but would not get a majority necessary to form a government. Its coalition partner will likely determine the new government position on a number of issues, including the transit negotiations.

The Cabinet of Ministers in Ukraine is in charge of the energy sector. This means that by September at the latest, Ukraine may have a new government and a new approach to the negotiations. Until the end of the electoral campaign, Ukraine’s decision-makers are unlikely to take reasonable positions in the trilateral talks out of fear of being labelled “Moscow’s agents”.

Indeed, Naftogaz’s negotiating position is hardly based on market realities. In April 2019, the company reduced its transit expectations and offered a new deal – 60 bcm/year ship-or-pay capacity to be booked by Gazprom plus 30 bcm/year of flexible capacity for 10 years to come.[6]

These volumes mirror the Commission proposals made during the trilateral talks in January 2019.[7] Yet, the proposal is hardly compatible with the company’s investment strategy. In 2019, Naftogaz plans to invest 34.5 billion Ukrainian hryvnias (1.32 billion US dollars) in production and only 7.3 billion Ukrainian hryvnias (0.28 billion US dollars) in transportation.[8] These figures are well below the required refurbishment costs, not to mention the investments needed to meet the company’s ambitious plans to expand production.

The most recent transit deal proposed by Naftogaz was also criticised by the Russian side as contradicting EU energy regulations, compulsory for Ukraine as it is a member of the Energy Community. The proposals “contradict the ideology of the [EU]’s Third Energy Package that requires that gas transportation capacities should be distributed” based on auctions, noted Russia’s Deputy Energy Minister Anatoly Yanovsky. “No such auction has been announced in Ukraine, and it is unclear whether they are planned for the future”.[9]

Both sides also have different visions for the future. Gazprom wants to have a flexible transit arrangement, while Naftogaz is eager to continue extracting rent income from the transit pipeline. Any compromise must consider the interests of both sides.

There are two options on the table. The first would revolve around a (temporary) extension of the existing contract with flexible transit volumes. For example, Gazprom could agree to book at least 300 bcm over the next 10 years with the obligation to use 2/3 of the booked transit capacity in the first five years of the contract duration.[10] However, it remains to be seen how such a proposal fits with the EU’s rules.

A second option is to follow the EU energy rules with transit capacities being booked at auctions held in Ukraine. However, this will require Naftogaz and the Ukrainian government to proceed with energy sector reform. Energy Community Secretariat Director Janez Kopač said that Naftogaz was slow to finalise the unbundling process and that the government in Ukraine “talks a lot about unbundling but is doing nothing”. Kopač added there was “still time” to reach a deal before the end of 2019, but “political will” was needed on the Ukrainian side.[11]

A no-deal outcome – while unlikely – is often portrayed as a situation leading to a major crisis. This perception may not reflect reality and is often used to further politicise already contentious negotiations. Gas supplies missing due to the absence of the Ukraine’s transit could be temporarily replaced by other sources including the Nord Stream-2, the TurkStream pipelines and underground gas storages.

Yet, in the medium term, Europe will still need additional supplies transiting via Ukraine due to decarbonisation initiatives that will increase consumption, falling domestic gas production and peak winter demand that extend beyond the capacity of non-Ukrainian pipeline routes. In this regard, negotiations should not be rushed to achieve results at any cost, not least in light of the ongoing political transitions in Brussels and Kiev.

There are alternatives, such as the precedent for a no-deal transit agreement, and these should be explored as a means to de-politicise the ongoing Ukraine transit negotiations, creating a better and more realistic environment for talks that could lead to a win-win compromise for all sides.

* Danila Bochkarev is a Senior Fellow at the EastWest Institute.

[1] For more details, please see Gazprom Export (http://www.gazpromexport.ru) and Ukrtransgaz data (http://utg.ua).

[2] Simon Pirani, “Russia-Ukraine Transit Talks: The Risks to Gas in Europe”, in Oxford Energy Comments, May 2019, p. 5, https://www.oxfordenergy.org/?p=31542.

[3] Alex Barnes, “EU Gas Import Infrastructure - Why More Is Good and Why Looking at Annual Utilisation Figures Alone Is Wrong – Part I”, in The Baltic Course, 6 July 2018, http://www.baltic-course.com/eng/energy/?doc=141330.

[4] Jack Sharples, “Ukrainian Gas Transit: Still Vital for Russian Gas Supplies to Europe as Other Routes Reach Full Capacity”, in Oxford Energy Comments, May 2018, p. 7, https://www.oxfordenergy.org/?p=31034.

[5] Hadrien Collineau, “Can Russia Continue to Keep Pace with Europe’s LNG Demand? The Answer Lies with Europe’s True Pipeline Capacity”, in WoodMackenzie Opinions, 12 December 2018, https://www.woodmac.com/news/opinion/european-pipeline-bottlenecks-may-limit-russian-gas-imports.

[6] “Ukraine to Offer to Russia to Reserve 60 Bcm of Transit Capacities for 10 Years at Talks Expected to Be Held in May – Naftogaz Official”, in Interfax-Ukraine, 25 April 2019, https://en.interfax.com.ua/news/economic/584124.html.

[7] “EU’s Sefcovic Says Russia-Ukraine Gas Deal Possible by End of 2019”, in RFE/RL, 21 January 2019, https://www.rferl.org/a/eu-sefcovic-sees-russia-ukraine-gas-deal-by-year-s-end/29722896.html.

[8] “Naftogaz Plans to Invest UAH 34.5 Bln to Boost Natural Gas Production in 2019”, in Ukrinform, 23 October 2018, https://www.ukrinform.net/rubric-economy/2564161-naftogaz-plans-to-invest-uah-345-bln-to-boost-natural-gas-production-in-2019.html.

[9] “Deputy Min: Proposals on Future Gas Transit Via Ukraine Puzzling”, in Prime, 16 May 2019, http://www.1prime.biz/news/0/{95390DB6-13CF-4540-9F34-C906640BEA0B}.uif.

[10] For more details see Marc-Antoine Eyl-Mazzega, “Russia-Ukraine Gas Relations: The Mother of All Crises or a New Start to 2030?”, in Edito Energie, April 2019, p. 5, https://www.ifri.org/en/node/15818.

[11] Stuart Elliott, “Solution to Russia-Ukraine Gas Transit Standoff May Only Be Reached in Jan: Boltz”, in Platts, 14 May 2019, https://www.spglobal.com/platts/en/market-insights/latest-news/natural-gas/051419-solution-to-russia-ukraine-gas-transit-standoff-may-only-be-reached-in-jan-boltz.

-

Dati bibliografici

Roma, IAI, luglio 2019, 6 p. -

In:

-

Numero

19|45