Transatlantic Tensions, Oil Imports and the Euro's Ambitions in International Trade

Transatlantic Tensions, Oil Imports and the Euro’s Ambitions in International Trade

Jesse Colzani*

When US President Donald Trump declared that the EU is “almost as bad as China, just smaller” and that his administration was “competing against the euro”,[1] it became clear that transatlantic relations were heading for a rough patch.

Europe is facing an arduous dilemma, caught between its continued reliance on the US as its major external ally and security provider and the growing realization that European interests may be gradually diverging from those of Washington.

The Trump administration’s criticism of Europe’s contribution to NATO, his unilateral withdrawal from the Iran nuclear deal and his imposition of US tariffs on trade with Europe have heightened tensions further. Some have begun questioning the future of the transatlantic alliance, and many more are exploring modalities to enhance the EU’s strategic autonomy from the US.[2]

Against this backdrop, European member states have on the one hand shown a renewed interest in strengthening the EU’s independent military capabilities, as demonstrated by the launch of PESCO and the establishment of a European Defence Fund (EDF). On the other, and mostly in light of Trump’s withdrawal from the Iran nuclear deal and re-imposition of blanket US sanctions, some in Europe have begun exploring means to strengthen the euro’s internationalization, seeking to diminish Europe’s reliance on the US dollar for international trade.

Over the past decades, the de-dollarization of the international economy has been a popular argument in certain quarters. Yet, due to the significant geopolitical implications of this move and the unrivalled dominance of the US over the international system, few have considered this a realistic scenario, especially in light of the close relation the close relations between Europe and the US.

This may no longer be the case. In the summer of 2018 the German Foreign Ministry called for payment channels independent of US as a means to salvage the nuclear deal with Iran and shield European companies doing businesses in Iran from secondary US sanctions.[3] A few weeks later, the President of the EU Commission Jean-Claude Juncker stated: “It is absurd that Europe pays for 80% of its energy import bill – worth 300 billion euro a year – in US dollar when only roughly 2% of our energy imports come from the United States”.[4]

For over fifty years the US dollar has been used as a major global currency. The US has managed to maintain its prominent position also due to its undisputed military supremacy. In particular, between 1973 and 1975, and following the crisis of Bretton Woods,[5] the US restored the status of the US dollar as the world reserve currency by offering military protection to the main oil producers in exchange for pricing oil exclusively in US dollars.[6]

That being said, a number of oil-producing countries, particularly geopolitical competitors to the US, have continued to challenge the dollar-centric system of international trade in the hydrocarbons industry.

In the fall of 2000, Saddam Hussein announced Iraq would no longer accept US dollars for oil payments. At the 2007 OPEC summit in Riyadh, the presidents of Iran and Venezuela urged OPEC to abandon dollar pricing since the US currency was at a record low.[7] The proposal was rejected by Saudi Arabia, leading Iran to shift away from pricing its oil in US dollars in response to international sanctions. In February 2008, however, OPEC Secretary General Abdalla El-Badri declared that the group “may switch to the euro within a decade to combat the dollar’s decline”.[8]

More recent challenges to the US dollar’s global influence are coming from China. In accordance with Beijing’s long-term currency internationalization strategy, China recently announced that crude oil futures contracts will be priced in yuan on the Shanghai International Energy Exchange.[9] While the yuan’s share of world’s currency reserves are expected to reach 4 per cent by 2022,[10] the yuan is unlikely to seriously challenge the dollar as the default currency for oil trade since it lacks political and macro-economic foundations.

Out of the list of major international currencies, only the euro comes close to the US dollar in terms of international reach and utility. Therefore, a number of countries are increasingly looking to Europe as their best chance to challenge the US’s dominance of the financial system.

In one of the numerous calls for de-dollarization coming from Moscow, the Russian Finance Minister declared: “if our European partners declare their position unequivocally, we could definitely see a way to use the European common currency for financial settlements, such as payments for goods and services, which today are often subject to restrictions”.[11] These words hold even greater significance considering the Russian Federation accounts for about 30 per cent of the EU’s crude oil imports.[12]

Venezuela has also begun looking to the euro as a potential alternative to the US dollar. Following the recent introduction of a state-issued, oil-backed national cryptocurrency, the Minister of Industry and National Production confirmed on 16 October 2018 that 2 billion euro will be injected into Venezuela’s economy to limit the effectiveness of US sanctions.[13]

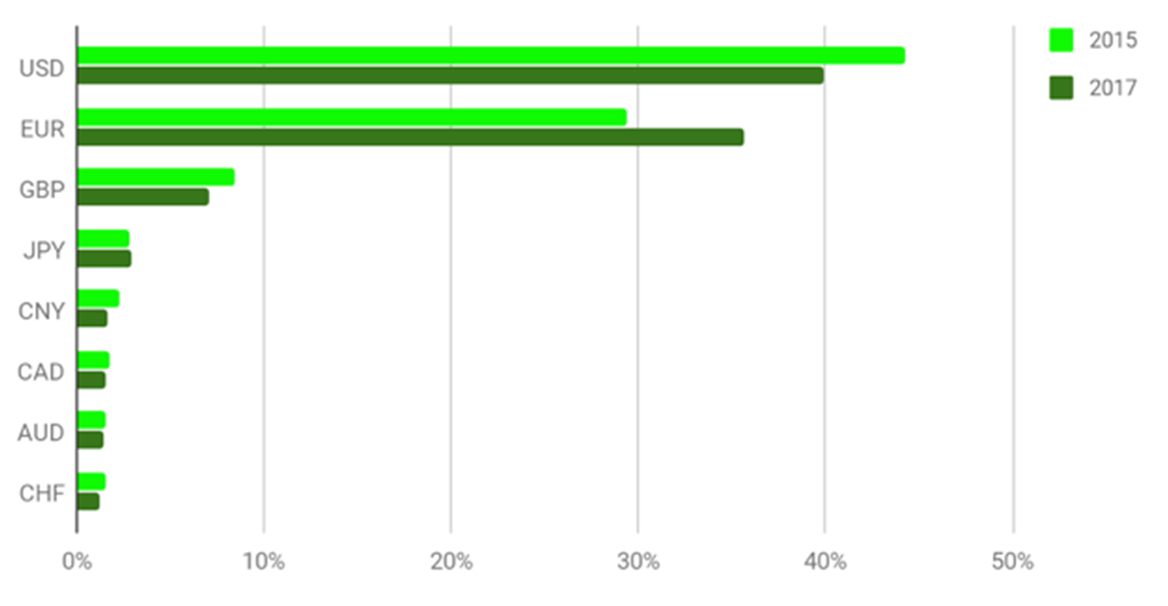

As a result, the US dollar is slowly losing power. Its reserves contracted to the smallest level since 2013, and its activity share dropped from 43.89 per cent to 39.85 per cent between 2015 and 2017. Meanwhile, the euro grew from 29.39 per cent to 35.66 per cent over the same period.[14]

Figure 1 | Currency activity share for domestic and international payments, 2015 and 2017

Source: Authors elaboration on SWIFT, RMB Tracker January 2018, cit.

President Juncker is clearly aware the euro is the only currency that could potentially compete with the US dollar at the international level. Yet, he is also aware of the serious geopolitical implications any such move could have on the broader transatlantic relationship and Europe’s economic and security relationship with Washington. During his State of the Union speech, Juncker emphasized the need to “complete [the] Economic and Monetary Union” as an indispensable step to “make Europe and the euro stronger”.[15]

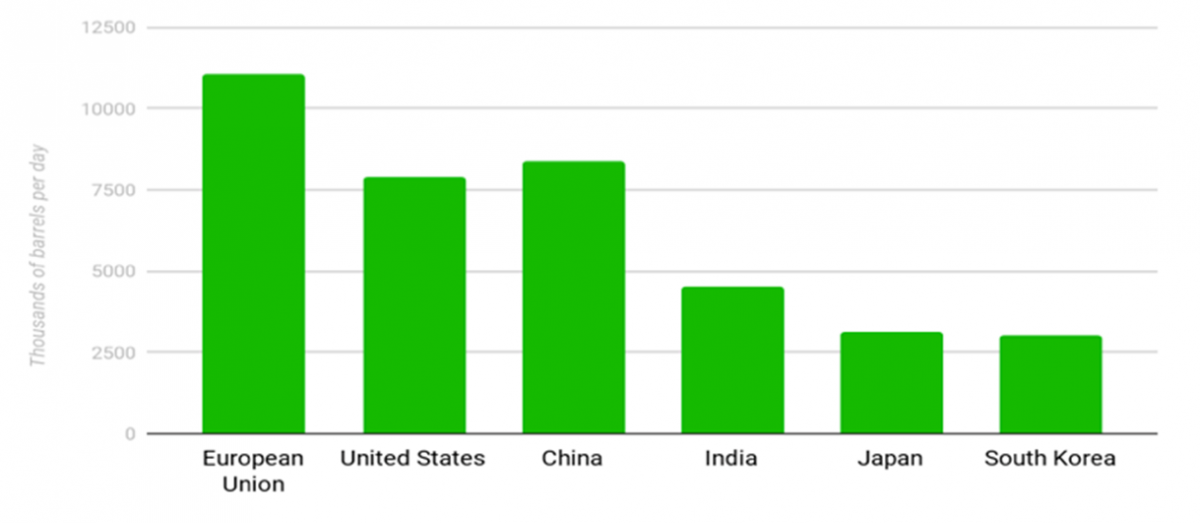

In this respect, Europe is best advised to adopt an incremental approach, balancing its close relations with the US with a gradual and expanding effort to strengthen the euro’s internationalization. Focusing on the oil sector could be a good starting point, given that Europe holds considerable bargaining power in this domain as the world’s largest importer of crude oil.

With imports approximately 20 per cent greater than those of the US, EU member states would be well placed to begin shifting oil imports from dollars to euros. Such a move would no doubt be considered a challenge to the dollar but, if managed correctly and incrementally, it could provide Europe with important leverage over Washington.

There are two main reasons for the EU to prioritize the oil market for its internationalization strategy. First, in order to effectively protect the Iran nuclear deal, Europe must create parallel financial channels capable of bypassing US sanctions on Iran while protecting EU businesses and companies from the threat of secondary sanctions. While it is unlikely that such efforts produce results in the short-term, beginning to address Europe’s overreliance on the US dollar for oil trade could serve to strengthen Europe’s position over time.

Second, the value of EU oil imports is roughly 200 billion US dollars but only 20 per cent of this intake is invoiced in euros. This means the EU is missing out on the possibility to invoice about 145 billion US dollars in its own currency[16] and, as a consequence, a potential reduction of interests rates in the internal market.

Figure 2 | Crude oil imports, 2017

Ultimately, it is unlikely that Europe will directly challenge the leadership of the US dollar in the short-to-medium term, as such a move would threaten the transatlantic alliance at a time when tensions between Washington and Brussels are already high. Given that Russia is perceived as a threat by a number of EU member states and that any effort to decrease Europe’s reliance on the US dollar would be considered a boon for Russia, few Europeans would be ready to sacrifice their alliance with Washington.

It is in Europe’s fundamental interest to strengthen and maintain the transatlantic alliance, yet this should not require the EU to sacrifice either its strategic autonomy or its future economic growth. Instead, gradually but decisively increasing the euro’s internationalization via the oil market would allow Europe to balance its relations with the US and third countries, while simultaneously increasing EU leverage and influence over both.

This, in conjunction with further efforts to enhance European security cooperation, could help establish the groundwork for the euro to “become the face and the instrument of a new, more sovereign Europe”,[17] one that would maintain close cooperation with Washington but also have the capacity to support more independent European policies on the world stage.

* Jesse Colzani holds an MA degree in Law from the University of Milan and is currently working for a non-profit organization in Brussels assisting international NGOs in legal matters.

[1] Shawn Donnan, “Trump Makes Clear EU Won’t Escape His Ire Over Trade for Long”, in Bloomberg, 31 August 2018, https://www.bloomberg.com/news/articles/2018-08-31/trump-makes-clear-eu-won-t-escape-his-ire-over-trade-for-long.

[2] In May 2018, German Chancellor Angela Merkel said “it is not the case that the United States of America will simply protect us. Instead, Europe must take its destiny in its own hands. That is our job for the future”. See her speech at the ceremony awarding the International Charlemagne Prize to French President Emmanuel Macron, Aachen, 10 May 2018, https://www.bundesregierung.de/breg-en/chancellor/speech-by-federal-chancellor-dr-angela-merkel-at-the-ceremony-awarding-the-international-charlemagne-prize-to-french-president-emmanuel-macron-in-aachen-on-10-may-2018-1008554.

[3] Guy Chazan, “Germany Calls for Global Payments System Free of US”, in Financial Times, 21 August 2018, https://www.ft.com/content/23ca2986-a569-11e8-8ecf-a7ae1beff35b.

[4] Jean-Claude Juncker, State of the Union 2018. The Hour of European Sovereignty, 12 September 2018, p. 10, https://ec.europa.eu/commission/sites/beta-political/files/soteu2018-speech_en_0.pdf.

[5] See Michael D. Bordo, “The Bretton Woods International Monetary System: A Historical Overview”, in Michael D. Bordo and Barry Eichengreen (eds), A Retrospective on the Bretton Woods System. Lessons for International Monetary Reform, Chicago and London, University of Chicago Press, 1993, p. 74-80, https://www.nber.org/chapters/c6867.

[6] Andrea Wong, “The Untold Story Behind Saudi Arabia’s 41-Year U.S. Debt Secret”, in Bloomberg, 31 May 2016, https://www.bloomberg.com/news/features/2016-05-30/the-untold-story-behind-saudi-arabia-s-41-year-u-s-debt-secret.

[7] AP, “Iran President Calls U.S. Dollar ‘Worthless’”, in NBC News, 18 November 2007, http://www.nbcnews.com/id/21870271.

[8] “OPEC Considers Switch to Euro Pricing”, in MEED, 8 February 2008, https://www.meed.com/opec-considers-switch-to-euro-pricing.

[9] Mamdouh G. Salameh, “The Petro-yuan: A Momentous Game Changer for the Global Energy Markets, the Global Economy & Sanctions”, in IAEE Energy Forum, third quarter 2018, p. 29-33, https://www.iaee.org/en/publications/newsletterdl.aspx?id=748.

[10] Chris Anstey, “Goldman Sees Yuan Gaining in Reserves at Cost to Dollar, Yen”, in Bloomberg, 3 September 2018, https://www.bloomberg.com/news/articles/2018-09-03/goldman-sees-yuan-gaining-in-reserves-at-expense-of-dollar-yen.

[11] Pepe Escobar, “How Singapore, Astana and St Petersburg Preview a New World Order”, in Asia Times, 6 June 2018, http://ati.ms/vBJCNx.

[12] Eurostat, EU Imports of Energy Products - Recent Developments, October 2018, https://ec.europa.eu/eurostat/statistics-explained/index.php/EU_imports_of_energy_products_-_recent_developments#Main_suppliers_of_natural_gas_and_petroleum_oils_to_the_EU.

[13] Andrew Rosati and Fabiola Zerpa, “Dollars Are Out, Euros Are In as U.S. Sanctions Sting Venezuela”, in Bloomberg, 16 October 2018, https://www.bloomberg.com/news/articles/2018-10-16/dollars-are-out-euros-are-in-as-u-s-sanctions-sting-venezuela.

[14] SWIFT, RMB Tracker January 2018, p. 9, https://www.swift.com/resource/rmb-tracker-january-2018-special-report.

[15] Jean-Claude Juncker, State of the Union 2018, cit., p. 11.

[16] See cumulative data for January-December 2017 in European Commission, Monthly and Cumulative Crude Oil Imports into the EU (2001-2017), https://ec.europa.eu/energy/en/data-analysis/eu-crude-oil-imports.

[17] Jean-Claude Juncker, State of the Union 2018, cit., p. 10.

-

Dati bibliografici

Roma, IAI, novembre 2018, 6 p. -

In:

-

Numero

18|65